Canadian Sscurities Regulators.

New rules adopted by Canadian securities regulators.

Starting July 15, 2014. Investment dealers must tell you what they charge before they do any transactions for you. Ask what charges are Income Tax Deductible?

So, let me refresh some key points.

First, there are sales charges. You have to choose a sales charge option when you buy a fund. Ask the seller about the pros and cons of each option.

Initial sales charge

You pay 0 to 4 per cent of the amount (or $0 to $40 of every $1,000 you buy). You and your adviser decide on the rate. The initial sales charge is deducted from the amount you buy. It goes to the adviser's firm as a commission.

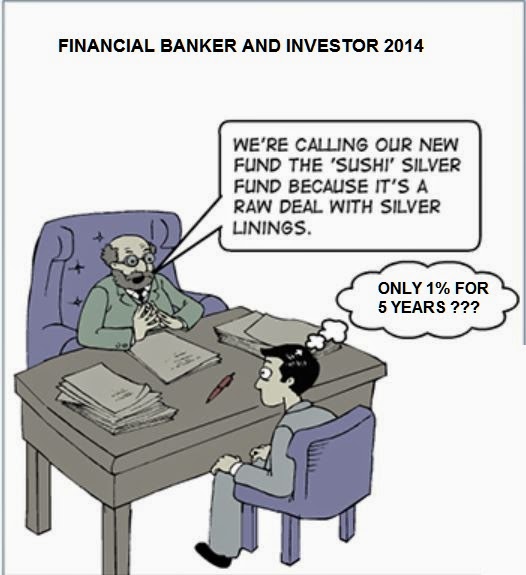

Deferred sales charge (DSC)

You pay 0 to 6 per cent of the amount ($0 to $60 on each $1,000 you buy). The DSC is 6 per cent if you sell within one year of buying, going down to 1 per cent within six years of buying, and is deducted from the amount you sell.

Then, there are fund expenses. You don't pay these expenses directly, but they affect you because they reduce the fund's return.

Management expense ratio (MER)

This is the total of the fund's management fee and operating expenses, adding up to 2.25 per cent.

Trading expeuse ratio (TER)

These are the fund's trading costs, adding up to 0.05 per cent.

Total fund expenses

XYZ Canadian Equity Fund's expenses are 2.3 per cent of its value in the latest year. This equals $23 for every $1,000 invested.

Ask for Fund Facts whenever your adviser recommends buying a specific investment.You can find Fund Facts at most manager's websites. The challenge is that there are 35,000 of them and they are updated periodically throughout the year.Ask your adviser about the cost of service. Converting it to dollars and cents per year "is not that hard to do," says Adams. "If s what they learn in their mutual fund licensing course."Be an informed investor. While you can't control stock markets or interest rates, you can control your costs.

Comments

Post a Comment