U.S.A. Tax Deal

U.S. Tax Deal Divides Citizenship And Privacy

OTTAWA—If one wants another clear-eyed illustration of the power imbalance between Washington and the Canadian government, one need look no further than a tax deal signed between the two countries last winter.

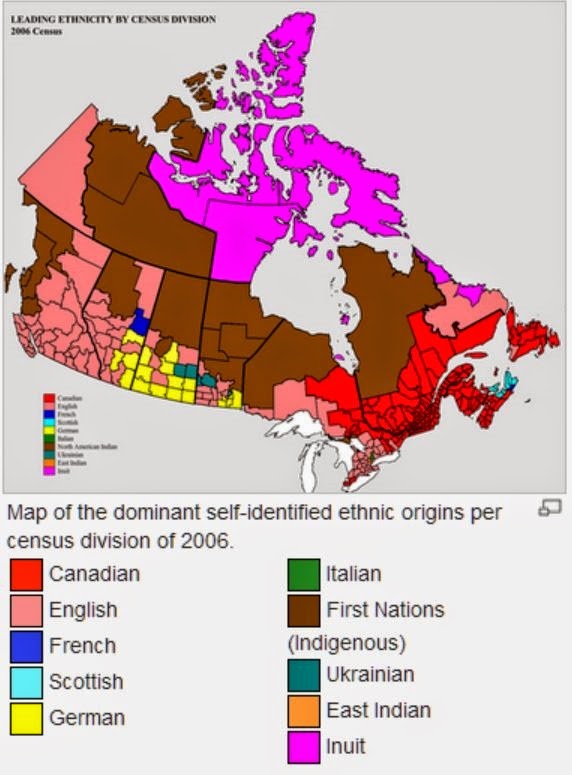

It is a deal which imperils the privacy of up to a million Canadians and creates a two-tier level of citizenship in this country, discriminating against citizens based on their ethnic origin.

At issue is the American Foreign Account Tax Compliance U.S.A. legislation with worldwide tentacles, aimed at finding American tax evaders living in other countries.

After protracted negotiations (FATCA was introduced in 2010), Ottawa allows the long arm of Uncle Sam access to personal financial information of Canadians deemed to be "persons of interest" due to their ETHNIC orgins.

Had Ottawa not complied, our financial institutions would have been slapped with a crippling 30 per cent withholding tax on financial transfers between U.S.A. and Canadian banks.

Comments

Post a Comment