Canadian Sscurities Regulators.

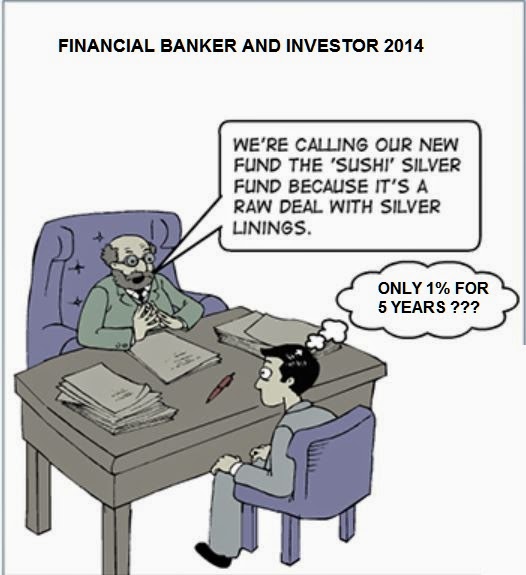

New rules adopted by Canadian securities regulators. Starting July 15, 2014. Investment dealers must tell you what they charge before they do any transactions for you. Ask what charges are Income Tax Deductible? So, let me refresh some key points. First, there are sales charges. You have to choose a sales charge option when you buy a fund. Ask the seller about the pros and cons of each option. Initial sales charge You pay 0 to 4 per cent of the amount (or $0 to $40 of every $1,000 you buy). You and your adviser decide on the rate. The initial sales charge is deducted from the amount you buy. It goes to the adviser's firm as a commission. Deferred sales charge (DSC) You pay 0 to 6 per cent of the amount ($0 to $60 on each $1,000 you buy). The DSC is 6 per cent if you sell within one year of buying, going down to 1 per cent within six years of buying, and is deducted from the amount you sell. Then, there are fund expenses. You don't pay these expense...

+(Large).jpg)

.jpg)